Digital payment systems are important in today’s commerce and change the ways of transactions for both businesses and consumers. As one of the world’s important technological innovation and trade hubs, digital payment systems play a great role in the development of future commerce in the UAE. At a time when rapid adaption of Digital Payment Solutions is propelled by government initiatives, innovation such as Smart UAEWallet, and DubaiPay, convenience is revolutionized and a cashless society is realized.

Overview of Digital Payment System in UAE

Digital Payments in UAE – Statistics & Facts Digital transformation probably hit the UAE as few other countries in the world have. Online transactions have grown exponentially in the region, stirred by wide usage of online card payment systems, mobile wallets, and e-commerce platforms.

Innovations like the Virtual Visa Card Instant provide consumers and businesses with a seamless and secure way to make digital payments. These innovations fall in line with the UAE’s National Payment Systems Strategy, which has emphasized the integration of advanced technology into the nation’s payment infrastructures. This ensures that convenience and efficiency come with heightened security, thus encouraging trust in digital payment ecosystems.

Types and Trends in Digital Payment Solutions

The different varieties of digital payment solutions in the UAE address the needs of all businesses and customers alike:

Online Payment Processing Services: These enable businesses to accept payments on digital platforms with convenience and flexibility.

Online Card Payment Systems: These are popular on e-commerce platforms, assuring smooth and secure checkout for end customers.

Smart UAEWallet and DubaiPay: Revolutionary contactless modes of paying that have clicked in less time due to their ease and instant transactions.

The trends of contactless payments, cryptocurrency adoption, and biometric authentications are acting to give shape to Digital Payments Market – Trends, Analysis & Forecasts. The in-depth look at the analysis of the trends of payments and e-commerce underlines that this sector is dynamic, fast-evolving, and driven both by technology and consumer needs for convenience.

Benefits of Digital Payments in the UAE Market

Among the many benefits of adopting digital payments for business and consumer:

Convenience and Speed: Digital payment systems complete transactions in real-time, enhancing user experience.

Global Reach: It allows businesses to engage with international markets without barriers that may be presented by traditional payment systems.

Security: Advanced encryption, tokenization, and fraud detection systems make transactions safer.

Cost-Efficiency: Digital payment solutions reduce operational costs related to the handling and management of cash.

Environmental Impact: Moving to a cashless system minimizes the ecological footprint associated with physical currency production.

These advantages integrated enable enterprises to stay competitive and fall in line with the UAE’s vision for a digital-first economy. In collaboration with a market research company in Dubai, actionable insights could be availed to optimize the use of digital payment systems.

Industries That Use Digital Payment Systems

A number of industries in the UAE have so far successfully integrated digital payment solutions into their operations for smoothness and improvement of customer experience:

Retail: Contactless in-store payments and online platforms have created frictionless, secure deals in shopping.

Travel and Tourism: Digital wallets and online payment systems meet the needs of technology-savvy tourists moving in pursuit of convenience.

Real Estate: Secured online systems enable property purchase and rent-related transactions with ease.

Healthcare: Digital payments smoothen the billing process, adding to patient satisfaction and operational efficiency.

Best Practices for Digital Payment Systems

For businesses that want to maximize the potential of digital payment systems in the UAE, here are some best practices to follow:

Select Appropriate Payment Solutions: The platform should be customized to meet specific business requirements and customer expectations.

Ensure Security: Make sure that proper encryption and fraud detection mechanisms are in place to safeguard consumer data.

Keep Up-to-Date on Regulations: Ensure adherence to the legal framework of the UAE and guidelines related to the payment system.

Consumer Behavior: Constantly monitor user preferences to develop better payment options.

A collaboration with a market research company in UAE will enable businesses to understand the emerging trends, consumer behaviors, and regulatory requirements that are vital for sustaining competitiveness.

Market Research Role in Digital Payments

Businesses that want to outpace others in the dynamic digital payments space will find market research very helpful. A market research company will be of immense help to businesses in:

Analyzing Consumer Preferences: It helps to understand the preferred payment methods of different demographics.

Track Emerging Trends : Stay updated about crypto currency adoption, mobile wallet use, and new technologies in biometric authentication.

Develop Strategic Insights: Based on data and insights, draw customized digital payment strategies that will help meet market demands.

In the dynamically developing industry, insights from play a great role in making informed decisions and taking advantage of digital payment opportunities.

Conclusion

Digital payment systems in the UAE are shaping commerce, bringing the nation toward a cashless, advanced future. From Smart UAEWallet to Virtual Visa Card Instant, each of these inventions has improved the convenience, security, and efficiency for both businesses and consumers alike.

To fully harness such developments, businesses need to change and move along with incorporating digital means of payment into their operations. Through the help of a best market research company in Dubai or the UAE, one will be able to understand comprehensive consumer trends, market dynamics, and thereby gain a strategic lead in this competitive world.

Frequently Asked Questions (FAQs):

The common methods include online card payment systems, mobile wallets like Smart UAEWallet, DubaiPay, and contactless by swiping NFC-based devices

DubaiPay is an online web portal for the residents and business houses in Dubai to pay bills related to government services with security and speed.

The Virtual Visa Card Instant enables users to make online secure payments without any actual card for convenience and to keep them safe from fraud.

With such advantages in terms of speed, hygiene, and convenience, contactless payments are top of demand, especially for in-store purchases in the pandemic era.

Mobile wallets, such as Smart UAEWallet, offer seamless ways to store payment details and execute instant transactions, thereby supporting the UAE’s movement toward a cashless society.

Online payment processing services enable businesses to accept payments on digital platforms, improve customer experience, and reach out to global markets.

Post a comment Cancel reply

Related Posts

Best Practices for Conducting Feasibility Studies in UAE Market

Feasibility studies in UAE market are the foundation of successful business ventures, within the highly…

The Impact of Data Analytics on The Healthcare market in UAE

The healthcare market in UAE has been highly transformative, majorly abetted by the integration of…

CLT (Central Location Testing) in UAE: Reliable Consumer Insights for Your Brand

CLT (Central Location Testing) in UAE serves as a cornerstone of effective market research, delivering…

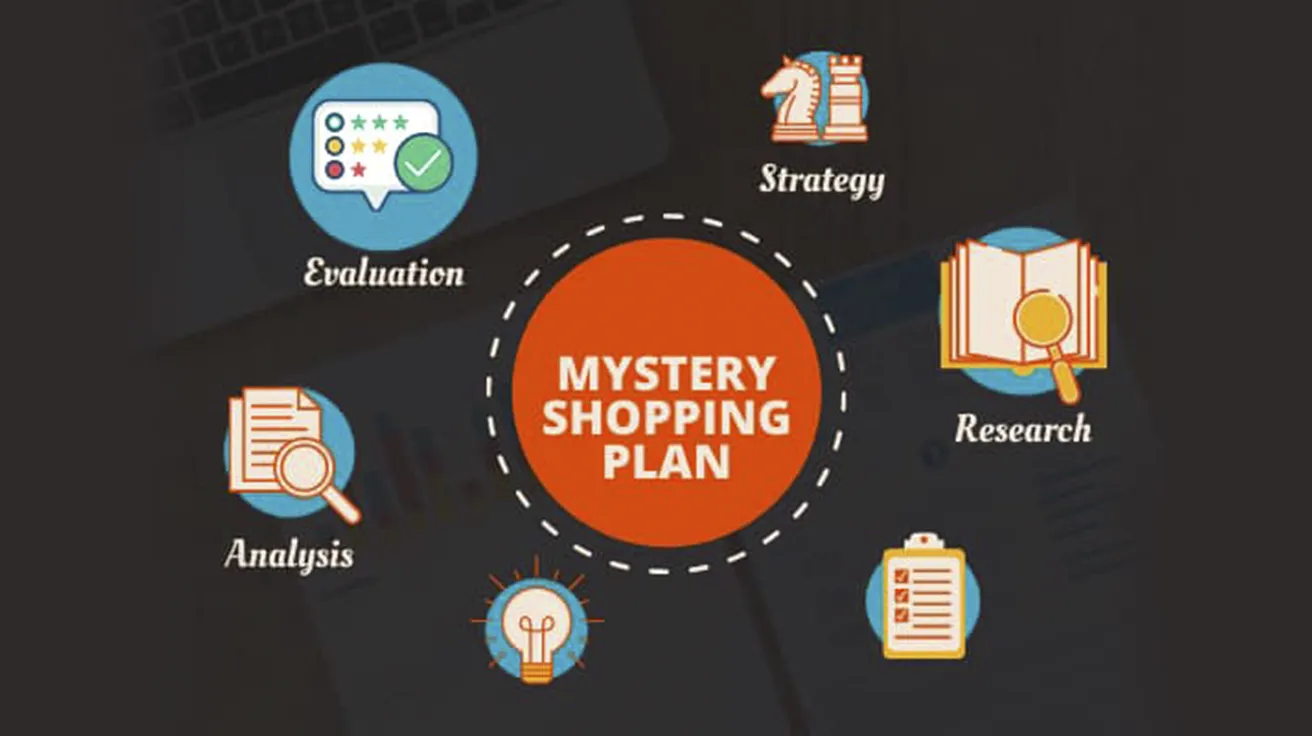

Mystery Shopping in UAE: Enhancing Service Quality Across Industries

Mystery Shopping in UAE will help the business meet customers’ expectations and stay ahead in…